Solving Financial Liquidity Challenges

AI Agents Are Driving The Lifeblood for Managing Global Liquidity Risk Operations

I am a firm believer that if we are looking into use-cases of AI Agents who are trying to solve things that humans are already incredibly good at and that we already do every day efficiently, then agents will add zero value. I do not need agents to (re)book a restaurant or go shopping on my behalf. That’s what makes life fun.

What I want, especially after a disaster of epic proportions that crypto turned out to be is a stable, reliable, cheap, and fast global financial system. And here, cognitive financial agents can actually add value.

One of the core tenets of a global financial system is the provision and management of liquidity. In the world of finance, liquidity refers to the ease with which an asset or security can be transferred without significantly affecting its price. High liquidity means assets can be sold rapidly at stable prices, while low liquidity indicates potential delays and price fluctuations. However, the existence of fraudsters, money launderers, and other payment criminals makes global financial transactions full of friction.

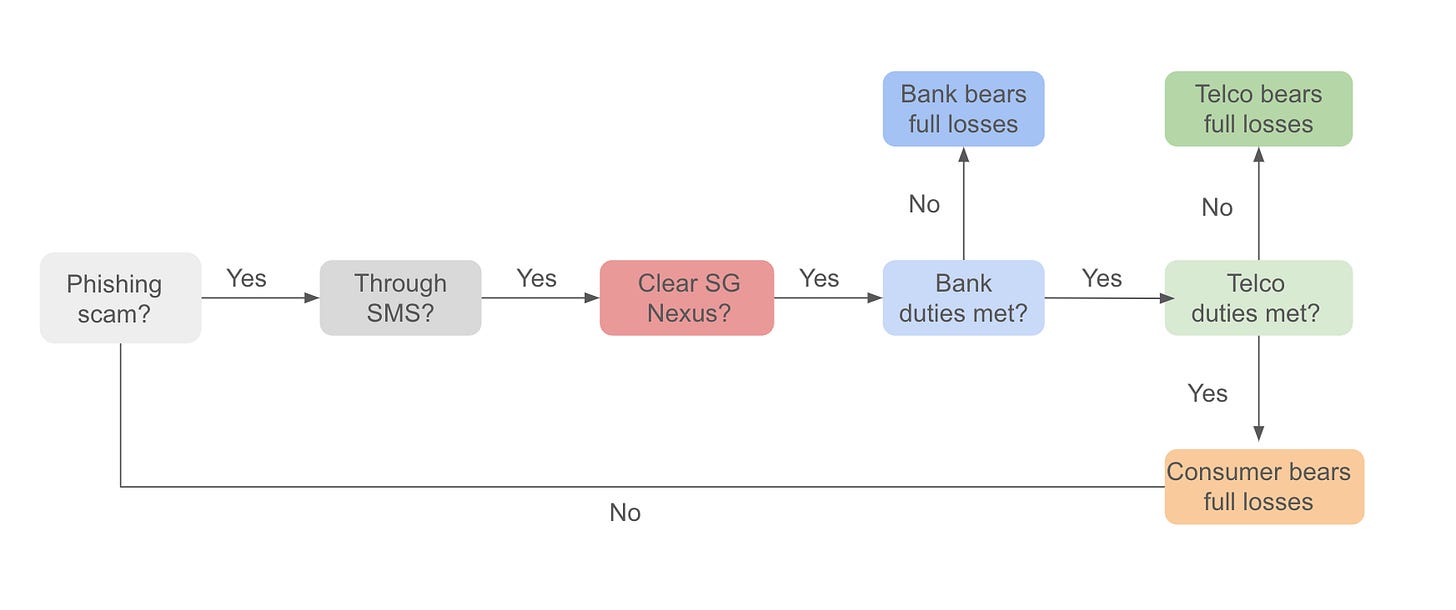

Source: Milken Institute - Shared Responsibility Framework (2025)

Since this friction is expensive in terms of liabilities, regulatory compliance, tech expenditures, and customer dissatisfaction, is the financial landscape constantly evolving and adapting as institutions seek to better manage cash flows and mitigate these market risks. Liquidity operations—the processes by which firms ensure they can meet short‑term obligations—rely on accurate, timely information. Recently, large language models in general, and autonomous agents, in particular, have begun to take a role in augmenting these operations by improving financial context management and improving the performance of automated routine tasks.

Understanding Liquidity Operations

Liquidity operations involve managing cash flows, funding short‑term obligations, and ensuring the smooth functioning of financial transactions. These operations require continuous monitoring of inflows and outflows, assurance that all duties are met, accurate forecasting of cash positions, and rapid decision‑making to respond to market shifts. Traditionally, banks and other financial institutions still have to rely on manual processes and legacy systems to achieve these goals.

However, as markets become more dynamic and data volumes grow, traditional methods often fall short of delivering the speed and precision required.

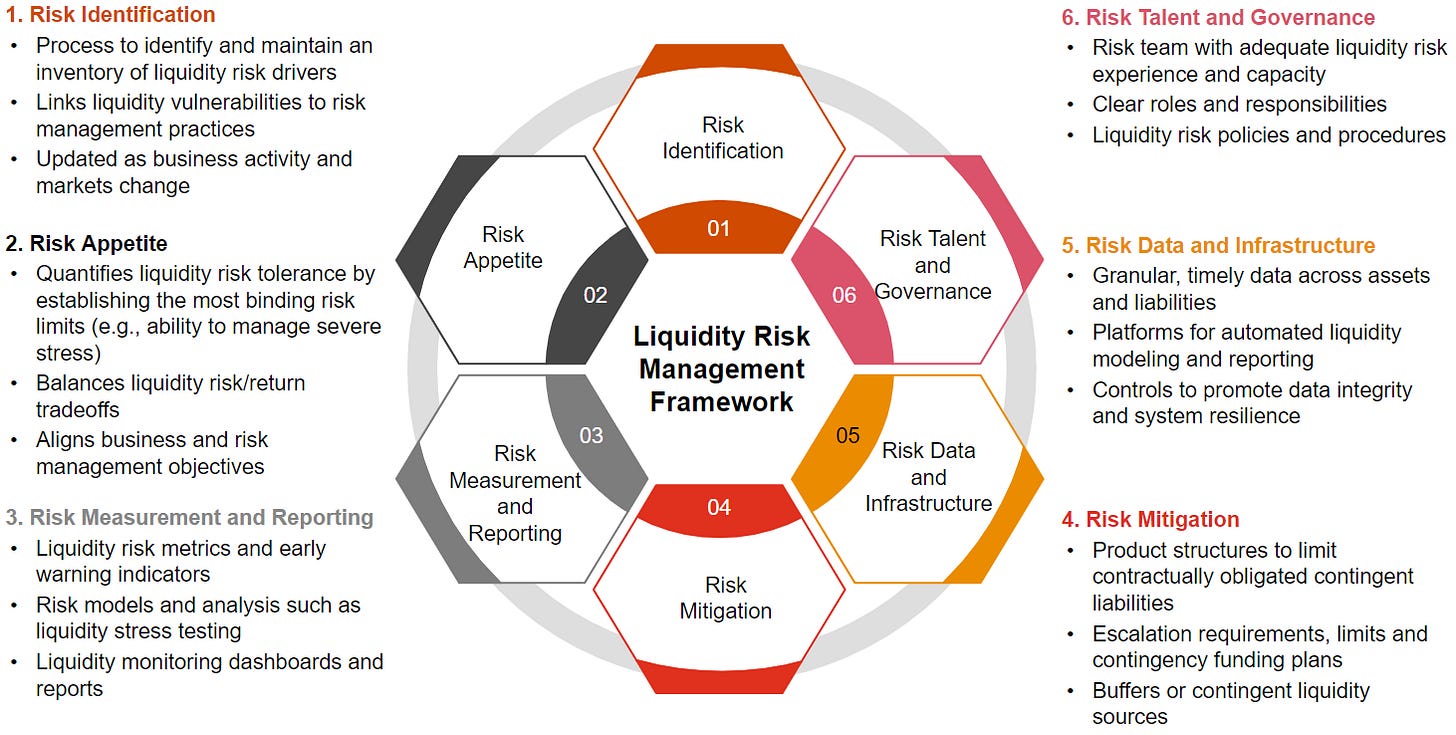

source: PWC - Managing liquidity risk at non-bank financial institutions

Effective liquidity management is not only about ensuring sufficient cash availability; it also encompasses risk management, regulatory compliance, and market stability. Firms must balance the need to hold liquid assets with the desire to invest for higher returns, all while adhering to regulatory guidelines. In this context, any tool that can provide more accurate, real‑time insights into market conditions is a valuable addition.

The Role of Agents in Liquidity Operations

For me, the value added through autonomous agents is clear. Agents offer a new approach to managing the vast amounts of data that underpin liquidity operations. Agents can interact effectively with extensive and diverse datasets that include financial reports, news articles, and regulatory documents. Agents can extract key information and generate coherent summaries, making it easier to assess current market conditions and predict future liquidity needs.

Processing and Analyzing Data: Agents sift through unstructured text to identify relevant trends and insights. For example, they can monitor news feeds and regulatory updates, providing a comprehensive view of regulatory obligations.

Automating Reporting: Routine tasks such as generating regulatory reports or cash flow forecasts can be automated using Agents. This not only saves time but also reduces the risk of human error.

Supporting Decision‑Making: By integrating narrative insights with quantitative data, Agents enhance financial context management. They enable risk managers and treasurers to respond quickly to changing market conditions by providing a clear, data‑driven picture of liquidity positions.

One innovative initiative for such a concept is Euroclear’s new seven‑year partnership with Microsoft. Through that project, Euroclear is aiming to modernize its financial market infrastructure by leveraging Microsoft’s cloud computing, generative AI, and analytics tools. The collaboration targets building a secure ecosystem for sharing financial data and a unified platform for customer interactions. For liquidity operations, this means consolidating various data streams—such as transactional data, regulatory updates, and market signals—into a single, interpretable view. Such integration enables financial institutions to better monitor liquidity flows and identify potential funding gaps in real-time, thereby improving overall market stability.

Agents‑Based Corporate Treasury Automation Tools

Also, corporate treasuries are increasingly adopting Agent-powered automation tools to handle routine yet data‑intensive tasks. Similar to the Euroclear project, treasuries are well advised to establish tools that can parse complex regulatory texts and internal documents to generate accurate cash flow forecasts and compliance reports. By automating the extraction and analysis of financial data, these systems free treasury teams from time‑consuming manual processes, allowing them to focus on strategic decision‑making. Moreover, by integrating qualitative insights with numerical data, these tools enhance financial context management. This integration helps treasurers detect shifts in liquidity conditions early and adjust their strategies accordingly, ensuring that firms maintain optimal cash reserves even in volatile markets.

Implementation Challenges & Considerations

While the benefits of integrating Agents into liquidity operations are significant, several challenges remain.

Data Quality and Integration

Garbage In - Garbage Out → The effectiveness of Agents depends largely on the quality and consistency of the underlying data. Many companies still struggle with legacy systems and siloed, fragmented data sources. Inaccurate or incomplete data can lead to incomplete context and thus flawed insights. This compromises the reliability of automated forecasts and reports. To overcome these challenges, firms must invest in data cleansing and standardization processes that ensure the information fed into Agents is accurate and up to date.

Model Interpretability and Transparency

Another major concern is the “black box” nature of many Agents. For most regulators that is a red line companies can’t cross. While these agentic models are amazingly capable of generating insightful summaries, understanding the rationale behind their outputs can be challenging if not impossible. This lack of transparency poses problems for risk management and regulatory compliance, as financial institutions need to explain decision‑making processes to regulators and internal stakeholders. Efforts are underway to develop methodologies that improve the explainability of Agents’ outputs, but this remains an area requiring further research and investment.

Security and Regulatory Compliance

Integrating Agents into liquidity operations also raises questions about data security and regulatory compliance. Financial institutions must ensure that AI systems do not expose sensitive information or create vulnerabilities that could be exploited by malicious actors. Regulatory bodies, such as the Bank of England, are already considering how AI models might be incorporated into stress tests to evaluate their impact on financial stability. Therefore, it is tantamount that financial institutions update their cybersecurity and liquidity management protocols and align their AI practices with evolving regulatory standards.

Third-Party Risks

Many of us have the collapse of Banking-as-a-service startup Synapse still in our hearts and minds. As the global financial ecosystem has evolved, relying on third‑party providers for AI and Processing solutions has become the norm rather than the exception. This dependency introduces additional risks, including additional cybersecurity vulnerabilities and challenges in monitoring third‑party compliance. Institutions must establish robust third‑party risk management frameworks to ensure that external vendors adhere to the same high standards of data quality, security, and transparency that internal systems require.

Future Outlook & Innovations

I stick to my opinion that autonomous agents are the future for managing scalable liquidity risk. Although the integration of Agents into liquidity operations is still in its early stages, the potential for further innovation is considerable. Advances in model architectures, data integration techniques, and explainability tools will continue to enhance the role of Agents in financial context management. In the future, we can expect:

Greater Integration: Agents will become more deeply integrated into enterprise systems, providing seamless data flows between different departments such as treasury, risk management, and regulatory reporting.

Improved Transparency: Ongoing research will likely yield new methods for elucidating the decision‑making processes of Agents, making them more transparent and acceptable to regulators.

Enhanced Customization: As financial institutions gather more domain‑specific data, Agents can be fine‑tuned to better address the unique needs of liquidity management, further bridging the gap between qualitative insights and quantitative analysis.

Expansion of Use Cases: Beyond liquidity operations, Agents may find applications in broader areas such as credit risk assessment, fraud detection, and investment analysis, further transforming the financial services landscape.

In closing

I think that autonomous agents can represent a significant step forward in the automation and enhancement of liquidity operations. By being able to process vast amounts of data and provide clear, actionable insights, agents help financial institutions manage cash flows, improve risk management, and maintain regulatory compliance. Real‑world examples like Euroclear’s partnership with Microsoft—demonstrate the practical benefits of these technologies in creating a more agile and informed financial environment.

While challenges such as data quality, model transparency, and security remain, the ongoing evolution of agents and related technologies promises to address these issues over time. As financial institutions continue to adopt and refine these tools, they will be better equipped to manage liquidity in an increasingly complex and data‑driven market. The future of liquidity operations lies in the effective fusion of human expertise and advanced AI, ensuring that firms remain resilient and responsive in the face of ever‑changing market conditions.

By embracing these innovations and addressing the associated challenges, the financial sector can enhance its operational efficiency and risk management capabilities, paving the way for a faster, cheaper, more reliable, more resilient, and more adaptable market environment.

And for me, that’s the value-added that doesn’t replace people but reduces friction.