Becoming Agent Bill Ackman

Maintaining Context for Decision Making in Financial Supermind Agents (SuperBill)

Why did the stock drop?

Is actually an interesting question.

Not because of your FOMO rising. Mainly because it refers to an event that has happened in the past. Therefore, theoretically all information required to answer it should be available. If you only would know where to look. A typical needle in the haystack problem. But it must be there. Somewhere out there in the vast digital realm of the Internet. If one would just manage to have perfect information about it at their fingertips. But there isn’t. Yet, this is a herculean task that Bloomberg and Reuters build multi-billion-dollar businesses off from.

If only it would be easy to answer that question it would be less value.

Figuring out the past is one thing. How about the future?

Will the stock drop?

Also an interesting question. But here, not all information is available because the future has not happened yet. All future outcomes are still possible.

All of them.

Stocks fluctuate for a variety of reasons. People want to cash in before tax season, rumors of a cheaper model coming out of China (DeepSeek), political changes, unsuccessful product launches (EA), or some of the many other reason (NVIDIA) that make the capital markets such a fascinating realm to work in.

Even legendary investors like Bill Ackman, analyze trading patterns, deal flows, news sentiment and many other indicators to predict what the value of an equity will be in the near to mid-term future. Some call them swing traders, momentum, or day traders. There are many investors who think they have found the secret to an infinite money glitch. And some, like Bill Ackman, do.

So when building SuperBill — an AI Agent for investing, what do we need to do?

Well, what all of these traders have in common is that the act of trading is will always be seen as an “action in context”. Hence, I’d argue that if for us meatbags context is important when making investment decisions, then context is also important when building SuperBill.

But what is context?

Context Discovery

Context in language refers to the background information, circumstances, or shared knowledge that influences the meaning of words, phrases, or sentences. It helps disambiguate meaning and provides deeper understanding.

Context can be:

Linguistic: The words surrounding a phrase that affect its meaning.

Situational: The external circumstances in which communication occurs.

Cultural: Shared norms, history, and beliefs that shape interpretation. Japan for example is a deeply context-sensitive culture.

For example, the phrase "That's a big deal."

In an earnings call, it may mean an important contract has been signed.

In casual Reddit commentary, it might just mean something surprising maybe significant. But just “big deal” could be even derogative or even indicate a negative connotation.

For decision-making in an investing context, investors should gather as much information as possible about a trade, as context includes the factors that influence and shape their choices. Examples for such priors are any constraints, goals, and external conditions. Clearly, having good data (accurate and timely) is expensive.

A fantastic resource here is Bill Ackman as he talks about value investing.

A decision taken in wrong context often leads to suboptimal outcomes.

Context-aware decisions would consider — and is clearly not limited to:

Historical Data: Past trends, experiences, and learned patterns. LTSM might be the “brain” you need here.

Environmental Factors: Market conditions, regulations, and competitive landscape.

Stakeholder Context: How different parties will be affected — who are stakeholders anyways?

Macroeconomic Context: Interest rates, inflation, and geopolitical risks.

Industry Context: Whether the company’s sector is growing or declining.

Regulatory Context: Any new government policies affecting the company.

Historical Context: The company's past performance during similar market conditions.

So, you want to buy NVIDIA?

Well, what would Bill do? The stock “just” dropped by 20% – …well “just” depends on when you are reading this. Time is also a measure of context. So, is now a good time to buy? Imagine you a fund manager deciding whether to invest in 10 million USD or not. Without the right context, they would look at the company’s recent profits and product announcements and decide it’s a good investment.

In the future we might have agents that have been trained with all the experience, knowledge, and context of Bill Ackman.

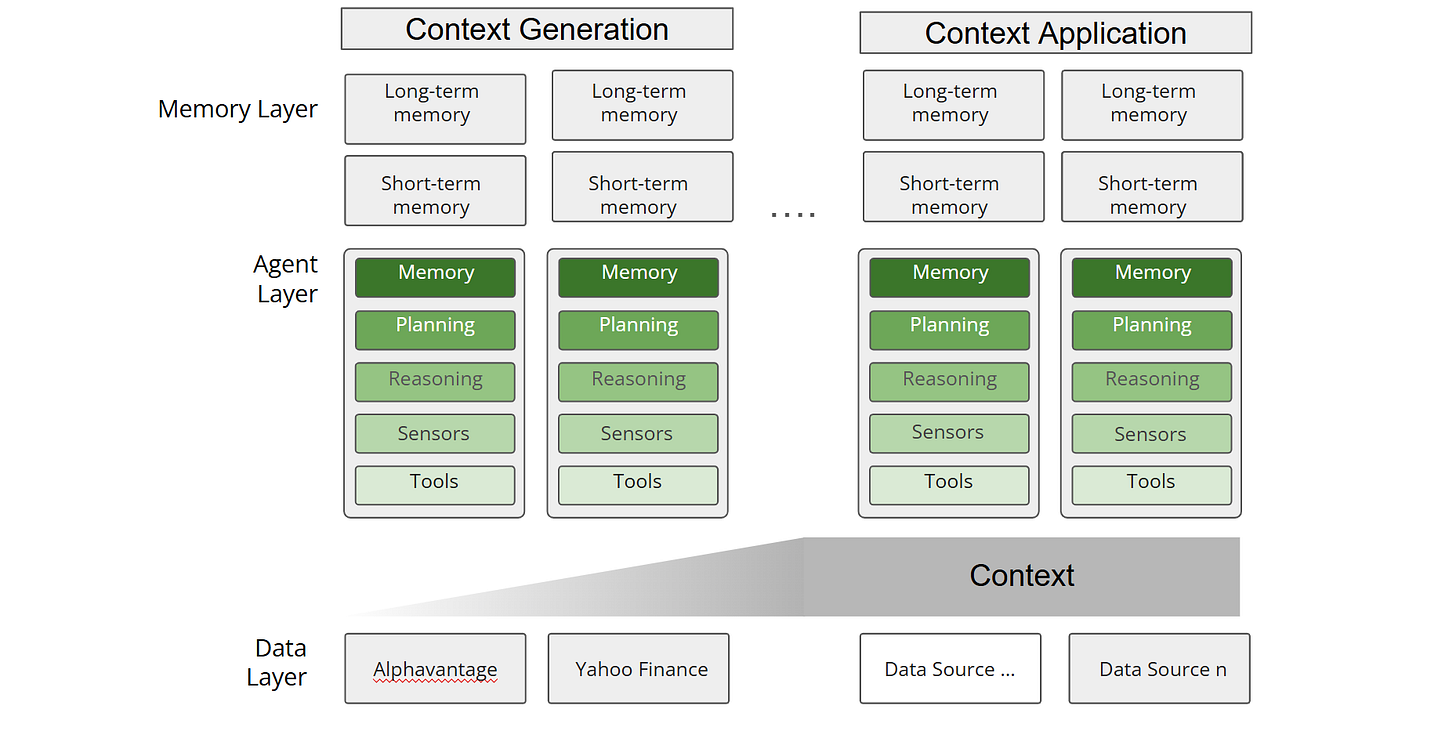

For Agents though, context is more complex.

And in most of these cases, what we take granted as humans, we specifically need to define for agents. What is the data we get, how will be encode/embed it so we have a shared context space across agents and interactions.

But also,

what are the tools to manage them,

what are measures to evaluate them, and

how can we integrate them into our analysis